General contracting industry outlook

The last few years have been a boom or a bust, depending on which general contractor you ask. GCs in the “boom” camp are growing their businesses thanks to green building, sustainability, and technology.

Introduction

The general contracting industry has grown over the last few years and its growing pains are showing. Prior to the recent onset of inflation, increased disposable income, low-interest rates, and a limited inventory of homes for sale, contributed to a tidal wave of home remodeling and renovations. What’s in short supply are available building materials and crews to install them. And while most companies have pivoted advertising and marketing to run online, most GCs don’t use new and emerging technology to its fullest potential.

The shortage of skilled workers has finally caught up with many. The gap between workers leaving the trades and new workers entering has widened in the last decade. Also, other events, such as the Great Resignation, have contributed to the skilled worker shortage that companies face today.

General contractors have recently had to deal with a lack of available building materials. Legacy building material shortages pushed consumers and contractors to look for available alternate building materials that are sustainable and enviro-friendly. Supply chain issues have improved since the onset of the pandemic and low inventory should soon be behind us.

While most other business models continue to explore the benefits of digital transformation, many GCs haven’t progressed beyond an essential website and a Construction Management System. Still, technologies like drones and Building Information Modeling (BIM) can save countless person-hours, and “smart cities” are under development as you read this.

The general contracting industry in 2022

To understand the trends that will affect the industry in the next few years, we need to look at the current state of the general contracting.

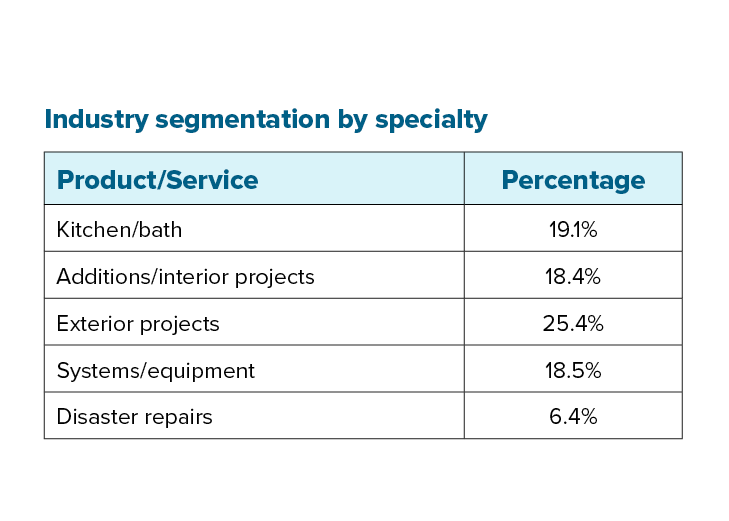

For the purpose of this report, a general contractor is defined as an individual or company specializing in repairing, renovating, or remodeling an existing home. Another recent BBB white paper offers data and statistics on homebuilders. In addition to interior and exterior residential projects, many GCs also provide disaster repair and systems and equipment upgrades and replacements.

Most GCs are small to medium-sized businesses that operate on a regional basis. Only a handful of companies have a larger footprint, usually related to disaster recovery renovations and remodeling. Many of the larger, regional GCs specialize in exterior renovation packages, such as windows, doors, roofing, and siding projects.

Principal project types:

- Residential additions, alterations, and renovations

- Construction management for residential remodeling

- Fire and flood restoration

- Interior Improvement

- Exterior improvement

- Kitchen and bath upgrades

- Other remodeling projects

The general contracting industry1 experienced a 3.8% growth rate and generated more than $111.5 billion in 2021. There are 493,728 active GCs in the U.S.

The industry is healthy, but the profit margins remain slim compared to many other industries. Lower profit margins are attributed to high costs associated with delivering on projects.

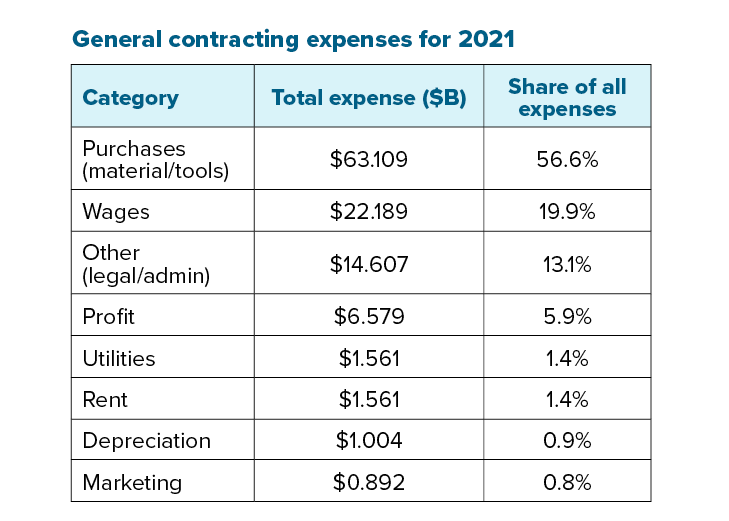

The biggest expense category for general contractors is project materials. Material costs are typically 60% of the total project. Labor costs come in at 20%, followed by general administrative costs and professional fees which make up 13%.

The average GC makes 5.9% profit on their projects. The last few years have put downward pressure on this number. Rising wages and supply chain constraints have led to large jumps in material costs.

Kitchen/bath

Kitchen and bath project prices can vary depending on utility service points and the finish schedule. Based on 2021 data1, the average cost for a bathroom remodel project was $12,095. A major bathroom upgrade averages $23,206 or nearly double the price. Kitchen remodels follow a similar pricing pattern; the average kitchen remodel costs $23,799, compared to a major kitchen renovation which averaged $43,907 in 2021.

Systems and equipment include plumbing, electrical, and HVAC systems. Heating and cooling projects represent the largest revenue generator in this sector. These are non-discretionary projects, as the home can’t function without water, power, and heating/cooling systems working properly.

Additions/interior projects

Room additions average out at $22,000 for bedrooms, rec rooms, and offices. Unlike a remodel with an existing structure in place, an addition requires all the elements of a new construction project, plus any system upgrades needed to handle the extra square footage.

Exterior projects

Popular exterior projects include decks, garages, carports, outdoor kitchens, and dining areas. In 2021, the average roofing project cost $6,377, while the average window/door replacement package cost $3,442.

Disaster repairs

Disaster repair makes up a small segment of the general contracting industry but remains somewhat recession-proof, with more homes are impacted by natural disasters every year. The most common projects of this segment include restoration, mold remediation, and contents restoration. In 2021, the average disaster repair project was worth $17,332 to a general contractor.

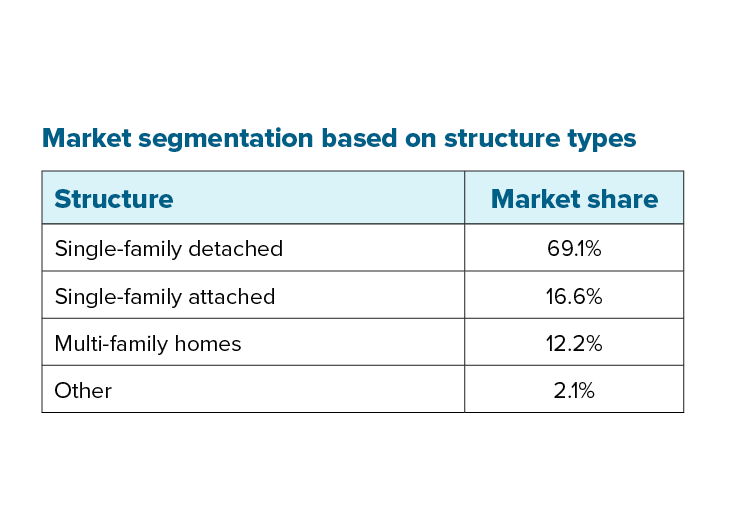

The growing demand for new homes increases the need for remodeling services in the U.S. The single-family home market makes up 85.7% of the general contracting industry revenue. The surge in property values allows homeowners to take out HELOC loans or refinance their mortgage to access the funds for remodeling and renovation projects.

The multifamily market is a vital revenue factor for GCs because it provides long-term maintenance work and income. Savvy property owners and managers realize that remodeling offers a double benefit. Well-maintained units see lower tenant complaints, streamlining their customer service process. And remodeled units collect higher rent payments to increase profitability for the owner.

The next five years: What to expect moving forward

The residential remodeling and renovation market can expect to see a continued annual growth of 1.3% through 20261. As interest rates increase, fewer homeowners will opt to buy and move to another home. Instead, they will leverage their home equity to cover remodeling and renovation costs.

For the past two years, material and workforce shortages have affected GCs, delayed projects and extended completion timelines. Material shortages will soon be a distant memory as supply chain bottlenecks continue to disappear. But, the skilled worker shortage will remain due to an aging workforce and the shortage of new workers entering the trades.

Lower short-term profit margins are expected due to fluctuating material costs, and higher wages to keep their crews intact. However, businesses that can pivot to using new materials, green building processes, or invest in new construction technologies can expect to see higher profit margins than those that don’t.

The next five years look to be both busy and profitable. Contractors who can capitalize on emerging industry trends will be poised to out-perform their competition.

Trends driving growth and change

Many of the emerging trends involve technology, while others address better PPE protection for workers; others result from changing government regulations2 regarding the Global Warming Potential (GWP) score of certain building materials. As a result, the industry will experience its most significant change in decades.

- Workforce woes

The construction industry has struggled with a skilled labor shortage since the Great Recession3. Every year, more workers are retiring from the industry compared to younger workers coming in. GCs will have to increase their efforts to find, train, and keep skilled workers to keep up with growing demand. Automation and robotics are potential answers to the worker shortage, but the technology is still years away from replacing human workers for many construction tasks. Another possible short-term solution is off-site construction (prefab or modular construction). For example, large assemblies such as walls and roof trusses get assembled at a factory and then transported to the job and installed.

- Building materials

As inventories increase and empty shelves disappear, the higher material costs should finally level off and subside. Green Building techniques are here to stay, and some states like California4 have adopted a “green building code.” Sustainability is another hot-button topic, and many renewable and eco-friendly building materials are now common in the marketplace; many products such as steel, copper, gypsum, and concrete now use recycled materials in their manufacturing processes. Also, living building materials5 to replace cement are gaining traction because cement production accounts for 8% of total global CO2 emissions.

- PPE equipment

PPE equipment has also evolved to keep workers safer than ever from the usual job site hazards, both visible and invisible6. For example, wireless sensors and trackers get attached to apparel or PPE products such as gloves, boots, vests, and hard hats. These wearables can monitor a worker’s repetitive motions, vital signs, movements, and slips or falls. Real-time health data can help keep workers safe and immediately notifies safety managers if a worker is at risk for injury.

- Digital transformation

Perhaps the most significant industry trend for GCs is using technology to design and build your remodeling projects. While some general contractors use software for accounting and estimation purposes, that’s the tip of the iceberg.

- Building Information Modeling (BIM)

BIM allows the contractor to “virtually build” the project for a homeowner. With the project created in cyberspace, changes to the roofline, window, and door locations, and even the floor plan occur without wasting materials or labor.

- Construction management software (CMS)

CMS systems allow a project manager to stay on top of plans, permits, budgets, material deliveries, and scheduling changes from a central dashboard and then communicate those changes to the homeowner in real-time. These systems help improve the bottom line, but there are some who still struggle to implement these the tools.

- Drone technology

Drone technology7 does much more than aerial photography, and its use grows 239% year over year. Drones allow contractors to perform inspections in and around hazardous areas without risking an employee’s safety. Drones can also perform property surveys and are now used to measure material stockpiles on the job site.

- Smart cities

One of the more exciting trends involves building or retrofitting existing buildings with Internet of Things (IoT) connections8. The data from citizens, devices, assets, and facilities gets processed to make infrastructure adjustments based on real-time usage.

The data allows the monitoring and managing:

- Traffic control systems

- Power plant output

- Utility services

- Water supply and treatment facilities

- Rubbish collection services

- Crime detection and prevention

- Information systems

- Schools and universities

- Libraries

- Hospitals

- Other community services

According to International Data Corporation (IDC), smart city investments totaled $124 billion in 2020, increasing 20% over smart city investments in 2019. That amount should increase to $203 billion by the end of 2024 and more than double to reach $676 billion by 2028. As a result, the construction industry, especially GCs, should prepare as IoT building materials begin to appear at supply houses.

What you can do

Identify the emerging trends that will have the most significant impact on your general contracting business, and begin implementing the products, services, and technology to streamline your business while increasing customer satisfaction ratings. Then, update your company website to discuss and promote the benefits of these products and technologies for your customers, such as energy savings, longevity, performance, and addressing sustainability concerns.

- Identify emerging trends

- Implement products, services, & technology

- Increase customer satisfaction ratings

- Update website with product benefits

After you’ve updated your website and messaging, it’s time to get back to the job site, right? For many GCs, the answer is yes, let’s get back to work. But before you go, would you be interested in knowing that there’s another way to distinguish yourself from most other GCs chasing after the same remodel and renovation prospects?

If you’re interested in building a better business, contact us today to learn more about the services, resources, and benefits that the BBB can provide.

(1) Remodeling in the U.S., IBISWorld, July 2021

(2) buildings.com/articles/43061/todays-top-roofing-trends-and-issues-ire-2021

(3) constructconnect.com/blog/top-5-commercial-construction-trends-2022

(4) hcd.ca.gov/calgreen

(5) biomason.com

(6) asme.org/topics-resources/content/11-construction-industry-trends-for-2022

(7) bigrentz.com/blog/construction-trends#efficient-technology

(8) explodingtopics.com/blog/construction-industry-trends

(9) Source: IABBB Research, 2022, Survey of BBB Accredited Businesses